mitchelldeason

About mitchelldeason

Gold IRA Investment Companies: A Complete Research

Investing in gold has been a time-honored strategy for wealth preservation and a hedge against inflation. Amongst the various strategies to invest in gold, Gold Individual Retirement Accounts (IRAs) have gained reputation as a way to include treasured metals in retirement portfolios. This report delves into the panorama of Gold IRA investment companies, exploring their choices, advantages, challenges, and the regulatory setting surrounding them.

Understanding Gold IRAs

A Gold IRA is a sort of self-directed particular person retirement account that permits traders to hold bodily gold, silver, platinum, and palladium of their retirement portfolios. Not like traditional IRAs that sometimes hold stocks, bonds, and mutual funds, Gold IRAs provide a novel opportunity to invest in tangible assets. This can function a safeguard towards economic downturns, forex devaluation, and inflationary pressures.

Advantages of Gold IRAs

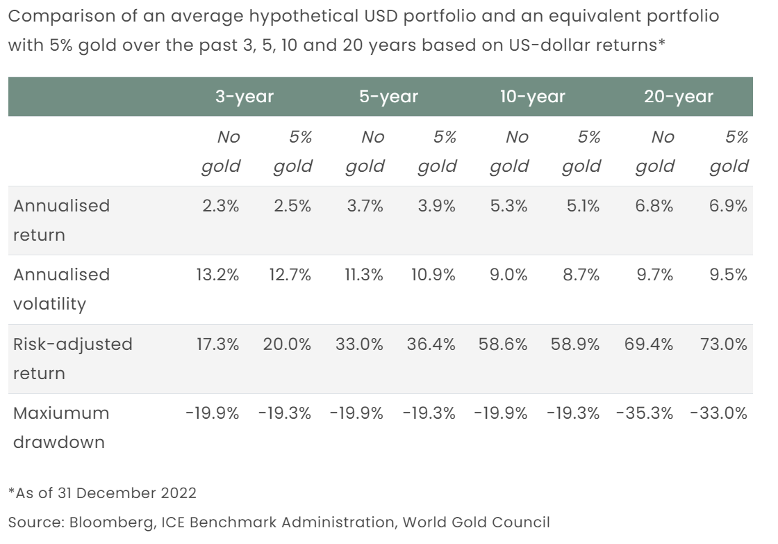

- Diversification: Gold IRAs permit investors to diversify their retirement portfolios. By together with precious metals, traders can cut back overall portfolio danger and enhance their potential for returns.

- Hedge Towards Inflation: Traditionally, gold has maintained its worth over time, making it an efficient hedge towards inflation. As the cost of residing rises, gold costs often enhance, preserving buying energy.

- Tax Benefits: Like traditional IRAs, Gold IRAs offer tax-deferred development. Investors don’t pay taxes on features till they withdraw funds throughout retirement, probably at a decrease tax charge.

- Bodily Ownership: Investors can own physical gold, which can present a sense of security. In contrast to stocks or bonds, gold is a tangible asset that can be stored and accessed immediately.

Key Gamers within the Gold IRA Market

The Gold IRA market is populated by several companies specializing in facilitating these kind of investments. Some of essentially the most notable Gold IRA investment companies embrace:

- Birch Gold Group: Birch Gold Group is famend for its intensive academic resources and personalized customer support. They provide a range of precious metals and assist purchasers in organising Gold IRAs.

- Goldco: Goldco has established itself as a frontrunner within the Gold IRA area, offering a wide collection of gold and silver merchandise. Their fame for customer support and transparency makes them a popular choice among traders.

- American Hartford Gold: This company focuses on offering investors with a easy method to Gold IRAs. They emphasize the significance of schooling and offer a price-match guarantee on gold and silver purchases.

- Noble Gold: Noble Gold stands out for its dedication to buyer education and repair. They supply a range of valuable metals and have a person-friendly platform for managing Gold IRAs.

- Regal Assets: Regal Assets is understood for its revolutionary method, permitting buyers to diversify into cryptocurrencies alongside precious metals. They offer a seamless process for establishing Gold IRAs and emphasize security.

Regulatory Environment

Investing in a Gold IRA comes with specific laws that firms must adhere to. The interior Income Service (IRS) governs the rules surrounding retirement accounts, together with what kinds of gold and treasured metals are eligible for inclusion in an IRA. Key laws include:

- Eligible Metals: The IRS specifies that solely certain types of gold and other precious metals could be held in a Gold IRA. For gold, the steel should be no less than 99. Should you loved this information and you wish to receive details about Www.Gold-Ira.Info please visit our own web site. 5% pure. This includes American Gold Eagles, Canadian Gold Maple Leafs, and certain gold bars.

- Storage Requirements: The IRS mandates that all bodily gold held in a Gold IRA have to be saved in an accredited depository. Investors can not personally hold the gold; it must be stored in a safe, IRS-compliant facility.

- Contribution Limits: Like conventional IRAs, Gold IRAs have annual contribution limits. For 2023, the contribution limit for individuals underneath 50 is $6,500, whereas those aged 50 and over can contribute up to $7,500.

Challenges and Considerations

While Gold IRAs supply numerous advantages, there are challenges and concerns that buyers ought to be aware of:

- Charges: Gold IRA investment companies usually cost various fees, together with setup charges, storage fees, and annual maintenance charges. These prices can erode funding returns, so it’s essential to grasp the price construction earlier than committing.

- Market Volatility: While gold is considered a safe haven, its value might be risky within the quick term. Buyers ought to be ready for fluctuations in value and have an extended-term funding horizon.

- Restricted Investment Options: Gold IRAs primarily concentrate on precious metals, which may restrict diversification in comparison with a standard IRA that may include stocks, bonds, and mutual funds.

- Complexity: The process of organising a Gold IRA can be extra advanced than traditional IRAs. Traders may need to navigate various rules, choose a good custodian, and choose eligible metals.

Conclusion

Gold IRA investment companies play a crucial position in facilitating investments in precious metals for retirement. With advantages corresponding to diversification, inflation hedging, and tax advantages, Gold IRAs will be an attractive possibility for buyers looking for to guard their wealth. However, potential buyers should carefully consider the associated fees, market volatility, and regulatory necessities. By conducting thorough research and selecting a reputable Gold IRA company, investors can effectively incorporate gold into their retirement strategy and secure their financial future.

No listing found.